In an era where digital payments and cryptocurrencies dominate financial headlines, a surprising trend has emerged in the United Kingdom: cash is making a comeback. Despite the push for a ‘cashless society’, the amount of physical currency in circulation has reached unprecedented levels, challenging our assumptions about the future of money. Let’s delve into this fascinating phenomenon and explore its implications for the UK economy and society.

The Surge in Cash Circulation: A Statistical Overview

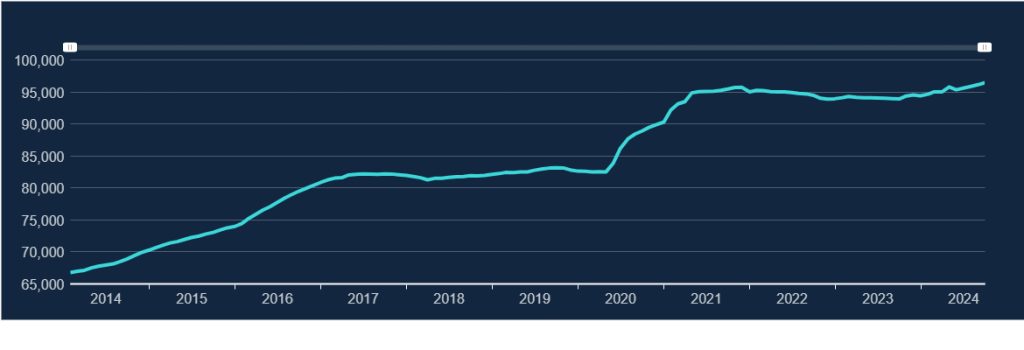

Recent data from the Bank of England has revealed a startling fact: cash in circulation in the UK has hit a record £96.4 billion, marking a 17% increase since the pre-pandemic era. This surge contradicts the narrative of an inevitable transition to a cashless society and raises important questions about the role of physical currency in modern times.

Breaking Down the Numbers

- As of September 2024, the total value of notes and coins in circulation reached £96,449 million.

- During the COVID-19 pandemic, cash circulation jumped by an astounding £13 billion in just 12 months, the most significant surge since records began.

- The average UK adult now holds over £1,800 in cash, a figure that has grown substantially in recent years.

Source: BoE

The Pandemic Effect: A Catalyst for Cash Hoarding

The COVID-19 pandemic played a crucial role in accelerating the trend of increased cash holdings. In 2020, as uncertainty gripped the nation, many Britons turned to cash as a tangible form of financial security.

Key Factors Contributing to the Pandemic Surge:

- Economic Uncertainty: As job losses mounted and businesses shuttered, many people withdrew cash as a precautionary measure.

- Reduced Spending Opportunities: Lockdowns and restrictions led to decreased consumer spending, resulting in unintentional savings for many households.

- Government Support: Stimulus payments and furlough schemes provided additional income, some of which was kept as cash.

Beyond the Pandemic: Why Cash Continues to Climb

While the initial surge in cash holdings can be attributed to the pandemic, the trend has continued well into 2024. Several factors contribute to this ongoing phenomenon:

1. Financial Uncertainty and Economic Instability

The global economic landscape remains uncertain, with concerns about inflation, geopolitical tensions, and potential market volatility. In such times, cash serves as a psychological safety net for many individuals.

2. Privacy Concerns in a Digital World

As digital transactions become more prevalent, so do concerns about data privacy and surveillance. Cash transactions offer anonymity that digital payments cannot match, appealing to those who value financial privacy.

3. Cost of Living Crisis

The UK, like many countries, has faced a significant cost of living crisis. Rising energy bills, food prices, and housing costs have led many to keep cash on hand for emergencies or to better manage their day-to-day expenses.

4. Evolving Trust in Financial Institutions

While trust in banks has generally recovered since the 2008 financial crisis, some individuals remain skeptical. Holding physical cash gives a sense of control over one’s finances that digital balances may not provide.

The Digital Paradox: Cashless Push Meets Cash Reality

The surge in cash circulation presents a paradox when juxtaposed against the push for a cashless society. While tech companies and some financial institutions advocate for digital payment solutions, the data suggests that many Britons are not ready to abandon cash entirely.

The Case for Digital Payments:

- Convenience: Digital transactions offer speed and ease, especially for online purchases and contactless payments.

- Financial Inclusion: Digital banking can provide access to financial services for those underserved by traditional banks.

- Reduced Crime: A cashless society could potentially reduce cash-related crimes such as theft and money laundering.

The Enduring Appeal of Cash:

- Tangibility: Physical currency provides a concrete sense of wealth and value.

- Budgeting Tool: Many find it easier to manage spending when using cash.

- Universal Acceptance: Cash remains widely accepted and doesn’t rely on technology or internet connectivity.

Implications for Policy and Society

The persistent demand for cash in the UK has significant implications for policymakers, financial institutions, and society at large.

For Policymakers:

- Maintaining Cash Infrastructure: There is a need to ensure that ATMs and cash-handling facilities remain accessible, especially in rural areas.

- Balancing Innovation and Tradition: Policies must strike a balance between encouraging financial innovation and preserving cash as a viable payment option.

For Financial Institutions:

- Hybrid Approaches: Banks may need to develop strategies that cater to both cash and digital preferences.

- Cash Management Services: There could be increased demand for secure cash storage and management solutions.

For Society:

- Financial Education: There’s a growing need for comprehensive financial education that covers both digital and traditional forms of money management.

- Inclusivity: Ensuring that the shift towards digital doesn’t exclude those who rely on or prefer cash transactions.

Looking Ahead: The Future of Cash in the UK

As we look to the future, it’s clear that cash will continue to play a significant role in the UK’s economy, at least in the medium term. However, the landscape is likely to evolve:

- Digital Currency Developments: The potential introduction of a digital pound by the Bank of England could reshape the currency landscape.

- Technological Advancements: Innovations in payment technologies may address some of the current concerns about digital transactions.

- Changing Demographics: Younger generations, more accustomed to digital finance, may gradually shift societal preferences.

Conclusion: A Balanced Approach to Currency

The surge in cash circulation in the UK challenges the notion that we’re heading towards an entirely cashless future. Instead, it suggests a more nuanced reality where both physical and digital forms of currency coexist.

For individuals, the key may lie in adopting a balanced strategy:

- Embrace the convenience of digital payments for everyday transactions.

- Maintain a reasonable amount of physical cash for emergencies and as part of a diversified financial approach.

- Stay informed about both traditional and emerging financial technologies.

As the UK navigates this complex financial landscape, one thing is clear: the death of cash has been greatly exaggerated. The future of money in Britain is likely to be a hybrid one, where digital innovation and traditional currency work in tandem to meet the diverse needs of a modern society.